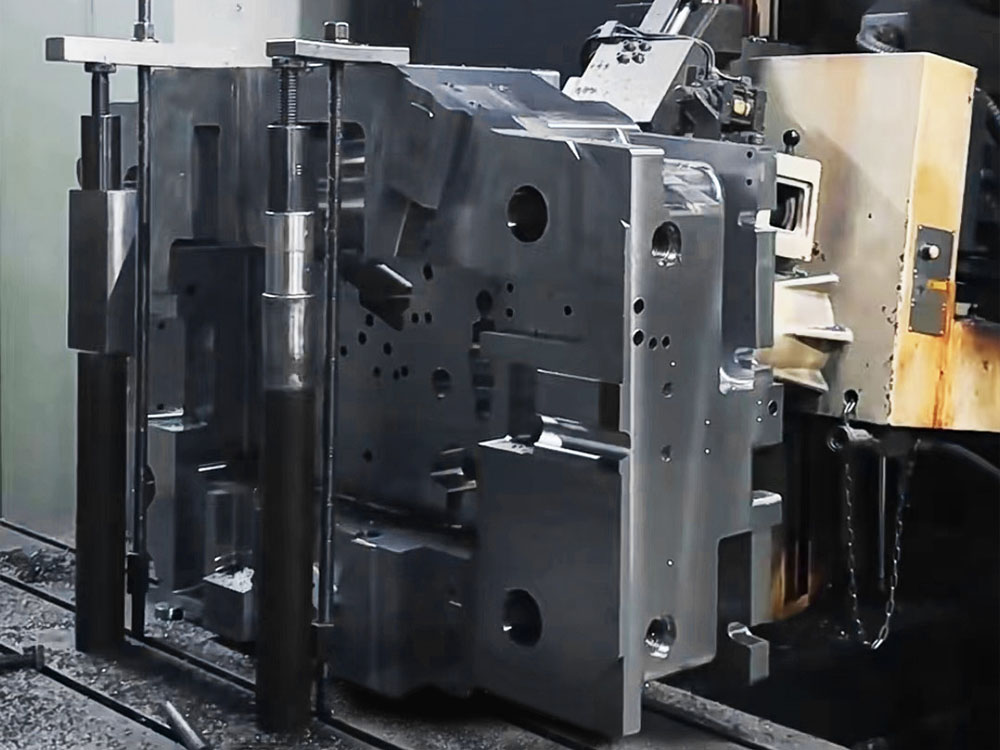

Accounting for the Cost of Equipment in the Mold Base Industry

In the mold base industry, accounting for the cost of equipment is crucial for operational efficiency, profitability, and long-term success. The cost of equipment includes not only the purchase price but also various other expenses associated with its acquisition, maintenance, and disposal. This article delves into the key aspects of accounting for the cost of equipment in the mold base industry, highlighting the significance of proper cost management and providing insights into best practices.

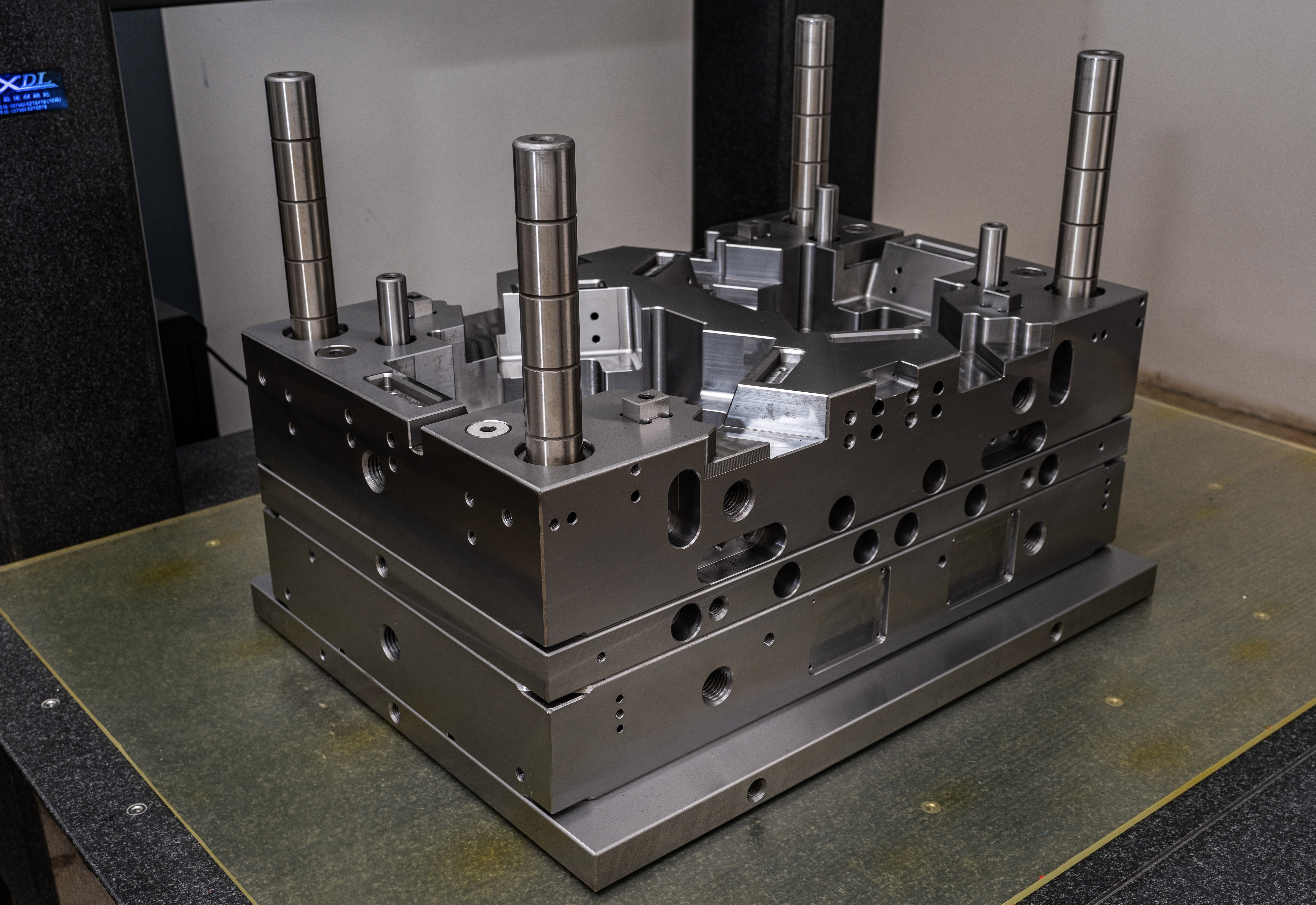

1. Initial Cost of Equipment

The initial cost of equipment comprises the purchase price, transportation charges, import duty, installation costs, and other associated expenses. It is imperative to accurately record these costs to determine the true acquisition value of the equipment. This information forms the basis for future cost calculations and financial reporting.

2. Depreciation and Amortization

Depreciation and amortization are accounting methods used to allocate the cost of equipment over its useful life. Depreciation applies to tangible assets, such as machinery and vehicles, while amortization is applicable to intangible assets, like patents and software. By systematically allocating the cost, businesses can match expenses with revenue generation and maintain realistic profitability figures.

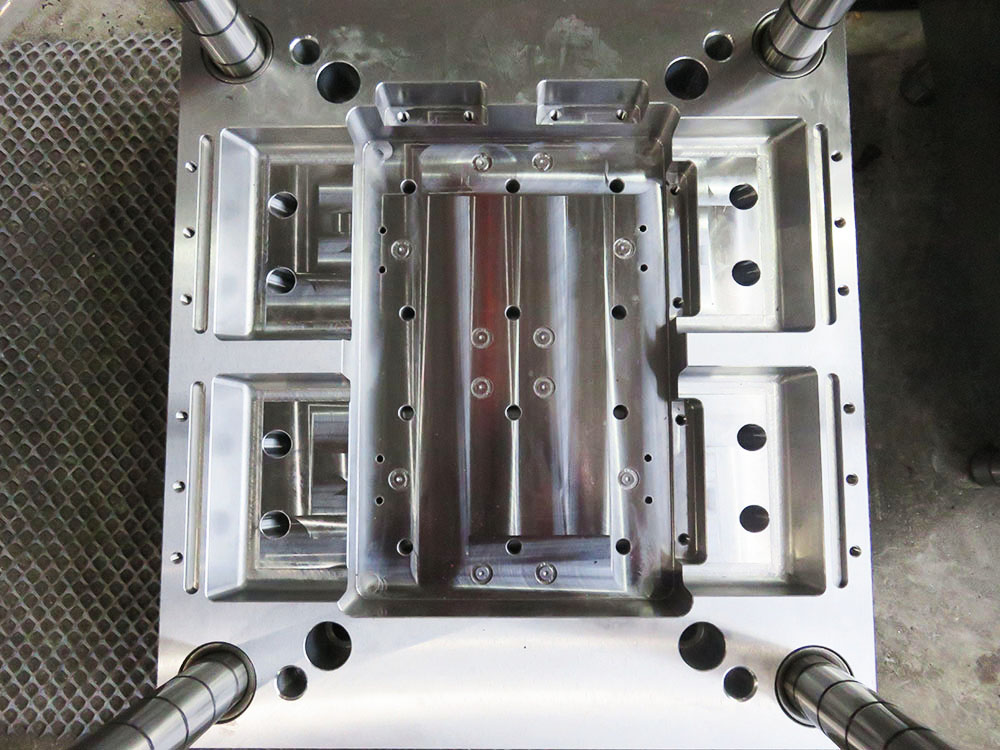

3. Maintenance and Repairs

Maintenance and repair costs are essential considerations in equipment accounting. Regular upkeep is crucial to ensure the equipment's optimal performance and lifespan. By accurately tracking maintenance and repair expenses, businesses can assess the cost-effectiveness of owning and operating specific equipment and make informed decisions regarding repair versus replacement options.

4. Insurance and Warranties

Insurance is a vital component of equipment cost accounting. By adequately insuring equipment against damage, theft, or any potential risks, businesses can mitigate financial losses and avoid interruptions in operations. Additionally, warranties provided by equipment manufacturers can help offset repair and replacement costs during the warranty period.

5. Disposal Costs

Equipment disposal involves costs related to environmental compliance, dismantling, transportation, and legal obligations. As equipment reaches the end of its useful life, accurate accounting of disposal costs becomes crucial for proper financial reporting and compliance with regulations.

6. Tracking and Documentation

Accurate tracking and documentation of equipment costs are essential for efficient accounting practices. Employing robust asset management systems and software can streamline the process and provide real-time insights into equipment-related expenses. Regular audits and inventory checks ensure data accuracy and enable data-driven decision-making.

7. Cost Benefit Analysis

Conducting a cost benefit analysis on equipment investments is a prudent strategy for mold base businesses. It involves weighing the upfront and ongoing costs with the potential benefits, such as increased productivity, reduced downtime, and improved product quality. This analysis enables businesses to make informed decisions, considering both financial and operational aspects.

Conclusion

Accounting for the cost of equipment in the mold base industry is vital for effective cost management and overall business success. By considering the initial cost, depreciation and amortization, maintenance and repairs, insurance and warranties, disposal costs, and employing proper tracking and documentation, businesses can ensure accurate financial reporting and informed decision-making. Effective equipment cost accounting maximizes operational efficiency, mitigates risks, and contributes to long-term profitability and sustainability.