How to Properly Allocate Accounting Entries for Purchased Inventory in the Mold Base Industry

In the mold base industry, proper allocation of accounting entries for purchased inventory plays a crucial role in maintaining accurate financial records and ensuring the smooth operation of the business. In this article, we will discuss the step-by-step process of allocating accounting entries for purchased inventory in the mold base industry.

Step 1: Identify the Purchased Inventory

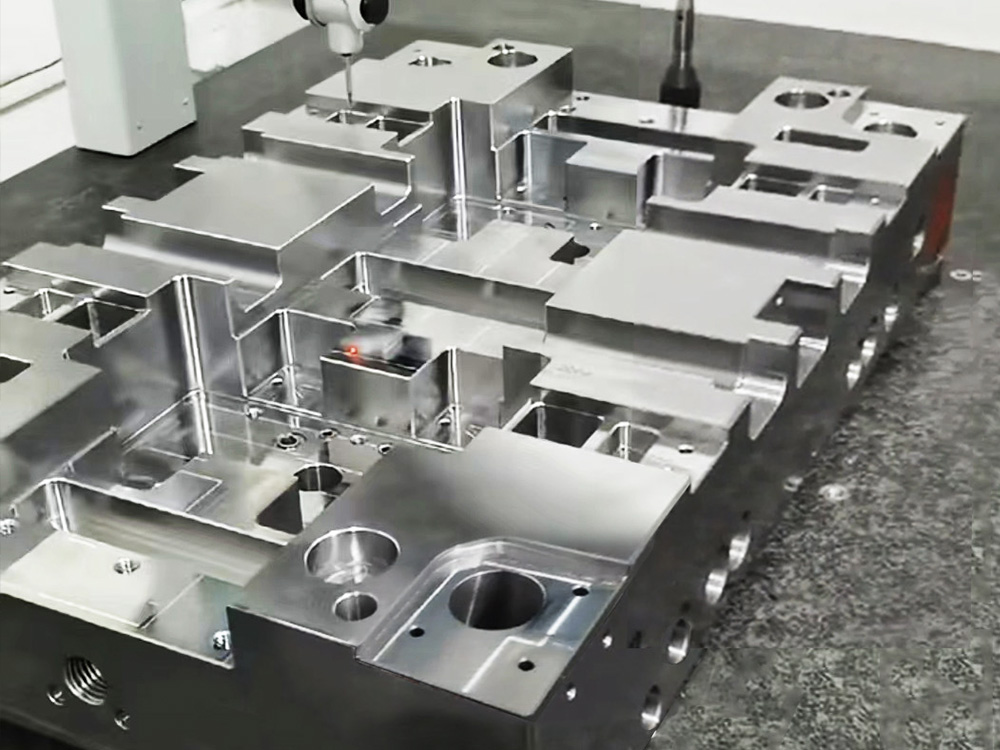

The first step in properly allocating accounting entries is to identify the purchased inventory. This includes raw materials, components, and finished goods that are acquired from suppliers for use in the production process. It is essential to accurately categorize and document the inventory to ensure proper allocation.

Step 2: Determine the Cost of Purchased Inventory

Once the inventory is identified, the next step is to determine its cost. This includes not only the purchase price but also any additional expenses incurred during the acquisition process, such as transportation costs or import duties. It is crucial to accurately calculate the total cost associated with each inventory item.

Step 3: Allocate Costs to the Appropriate Accounts

After determining the cost of purchased inventory, it is necessary to allocate the costs to the appropriate accounts. In the mold base industry, commonly used accounts for inventory allocation include:

Raw Materials Inventory:

This account is used to record the cost of raw materials acquired for production. It includes items such as steel, aluminum, plastics, and other materials used in the manufacturing process of mold bases.

Work in Progress Inventory:

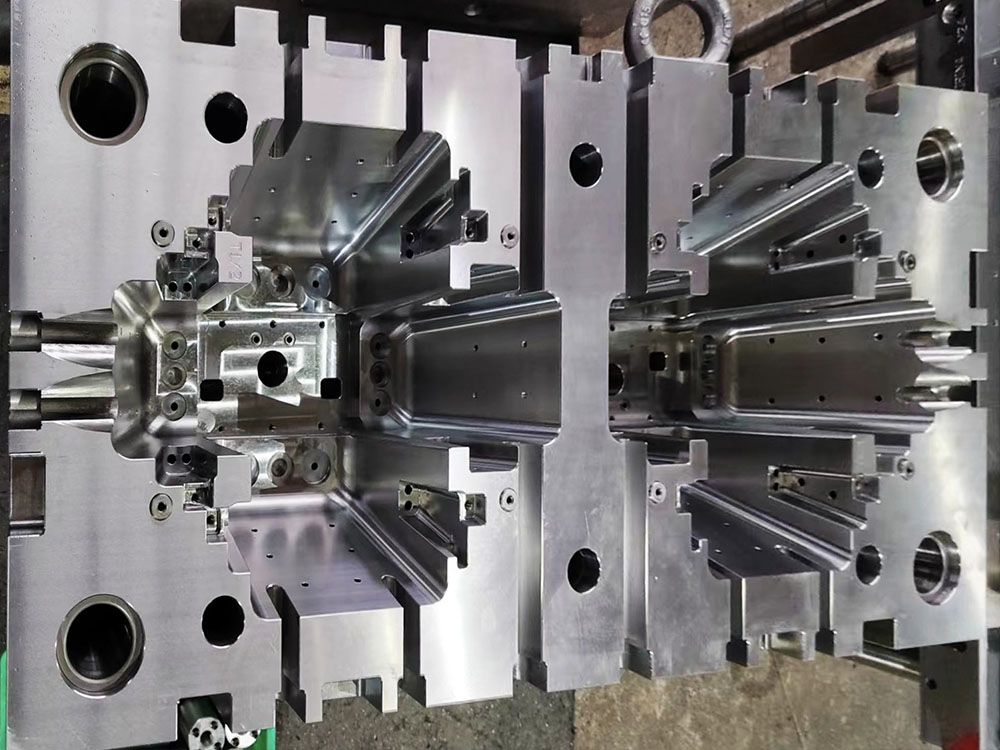

This account is used to record the cost of partially completed mold bases. It includes the direct labor, materials, and overhead costs associated with the ongoing production process.

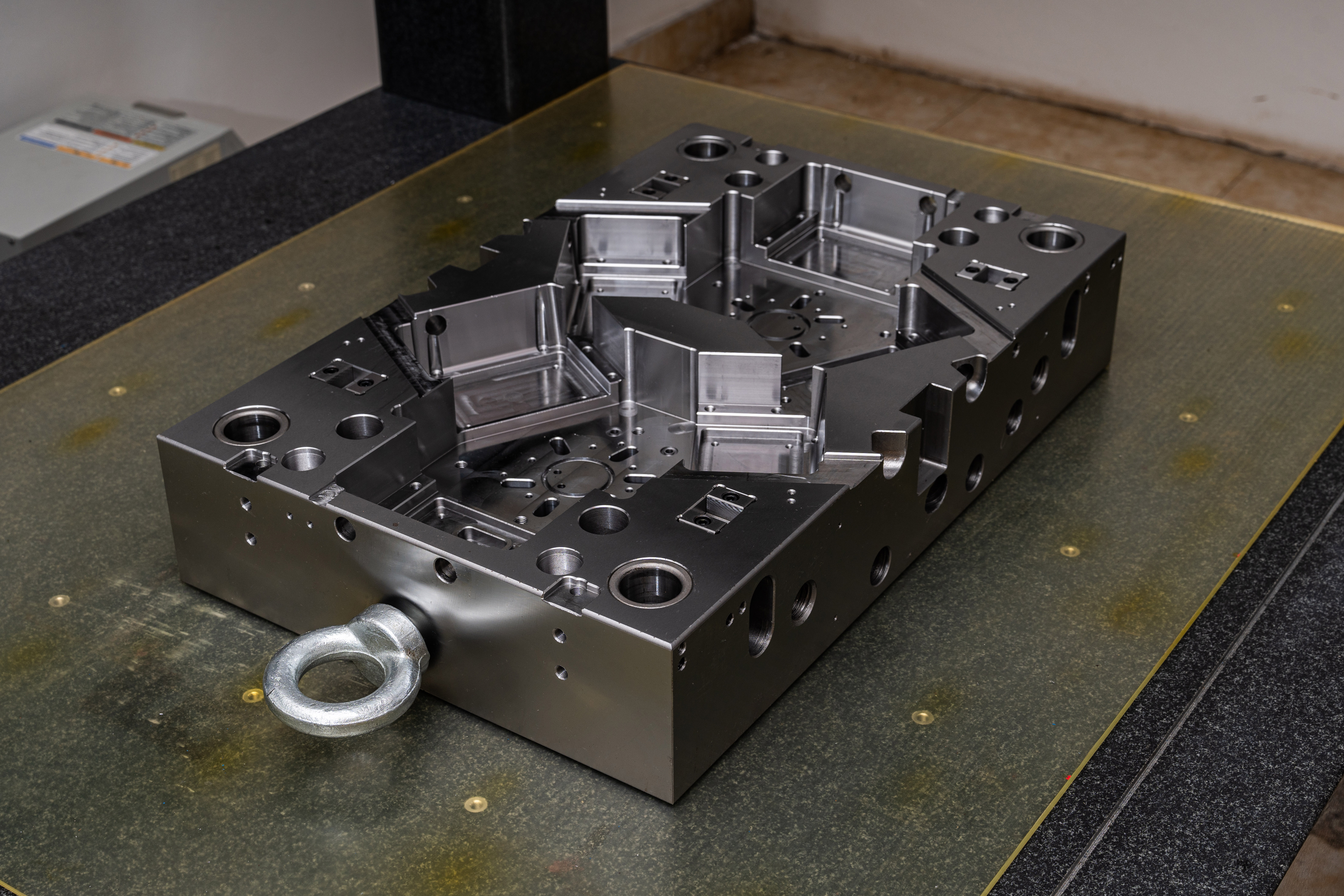

Finished Goods Inventory:

This account is used to record the cost of completed mold bases that are ready for sale or distribution. It includes the direct labor, materials, overhead costs, and any additional costs incurred during the manufacturing process.

Cost of Goods Sold:

This account is used to record the cost of inventory that has been sold or used in the production process. It includes the cost of purchased inventory, direct labor, and manufacturing overhead.

Step 4: Maintain Proper Documentation

It is essential to maintain proper documentation for all accounting entries related to purchased inventory. This includes purchase orders, invoices, shipping documents, and any other relevant paperwork. Documentation ensures transparency and provides an accurate audit trail for future reference.

Step 5: Regularly Review and Reconcile Inventory Accounts

Regular review and reconciliation of inventory accounts are necessary to identify any discrepancies or errors in the allocation of accounting entries. This helps prevent inaccuracies in financial statements and allows for timely adjustments if required. It is advisable to conduct periodic physical inventory counts to verify the accuracy of recorded inventory levels.

Conclusion

Proper allocation of accounting entries for purchased inventory is essential in the mold base industry to maintain accurate financial records and ensure the smooth operation of the business. By following the step-by-step process outlined in this article and maintaining proper documentation, mold base companies can effectively allocate costs and track inventory-related transactions.