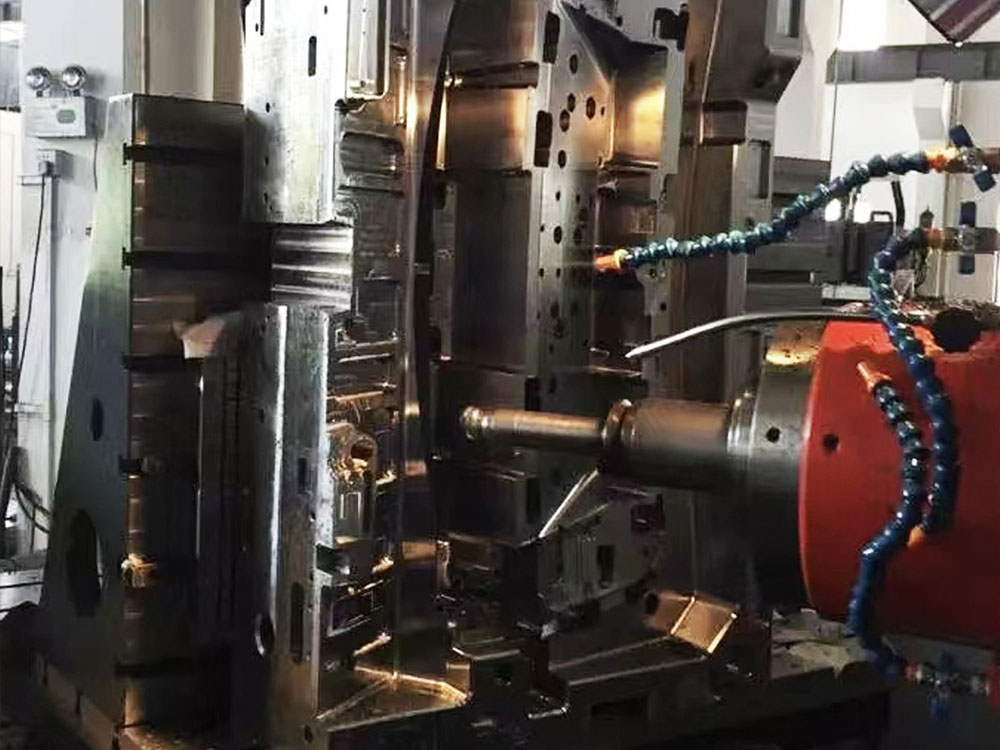

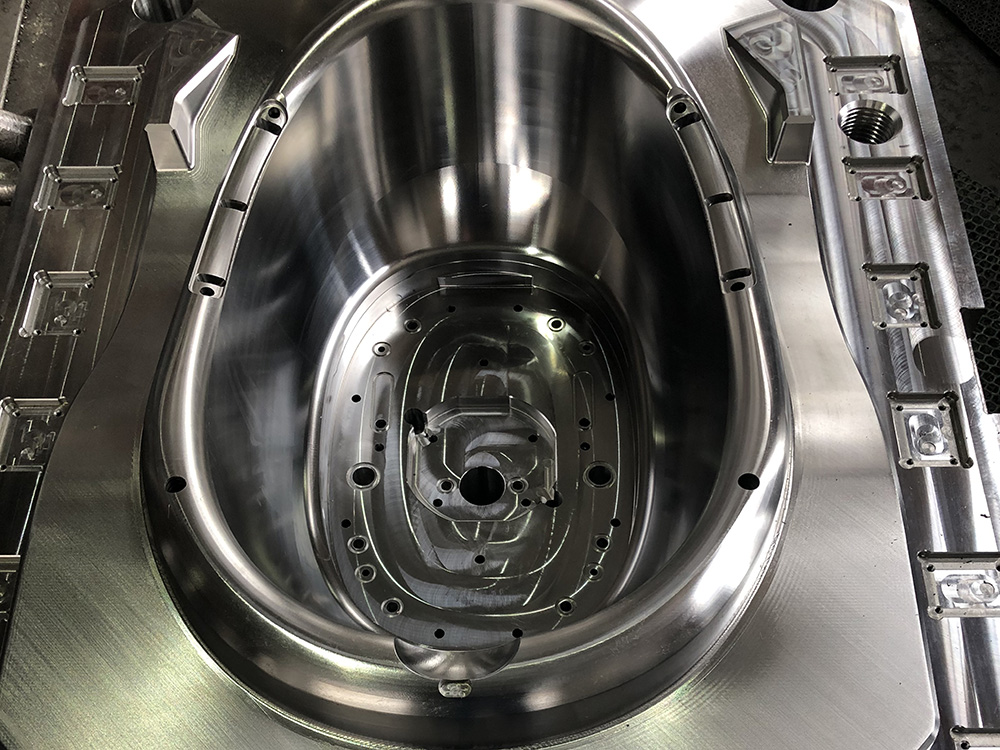

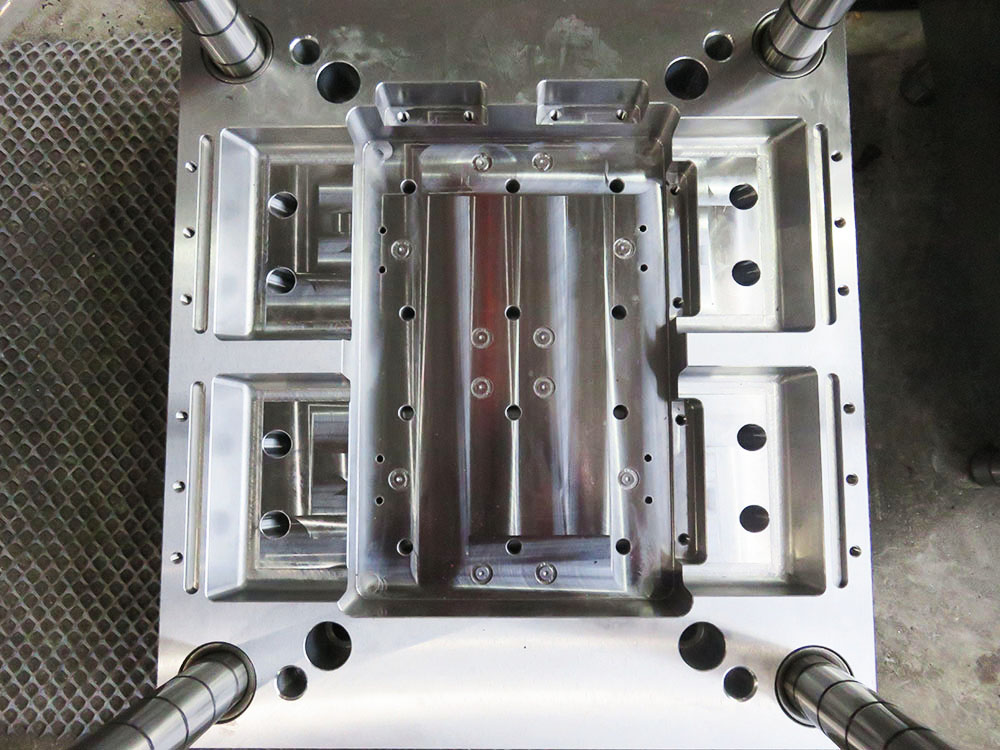

Introduction to Mold Base Industry

The mold base industry plays a crucial role in the manufacturing sector, providing the foundation for creating various types of molds used in industries such as automotive, aerospace, electronics, and consumer goods. Mold bases are standardized components that serve as the framework for the mold, holding all the necessary components together. In this article, we will explore the process of declaring customs classification for mold frames, focusing on the specific steps and considerations involved.

Step 1: Understanding Customs Classification for Mold Frames

Before submitting the declaration, it is essential to have a clear understanding of customs classification for mold frames. Customs classification codes identify the specific category or type of goods for import or export. Mold frames typically fall under a specific classification code, ensuring accurate documentation and appropriate customs duties.

Step 2: Gathering Relevant Information

Prior to declaring customs classification for mold frames, it is necessary to gather all the relevant information related to the product. This includes detailed technical specifications, such as the dimensions, material composition, and weight of the mold frames. Additionally, information regarding the intended use and any applicable certifications should also be collected.

Step 3: Reviewing the Harmonized System (HS) Codes

The Harmonized System (HS) Codes are an internationally standardized system for classifying goods. These codes are used by customs authorities to determine the applicable customs duties and regulations. Therefore, it is crucial to review the HS codes related to mold frames to ensure accurate classification. The relevant HS codes for mold frames can be found in the customs tariff of the respective country.

Step 4: Consulting with Customs Authorities

For accurate customs classification of mold frames, it is advisable to consult with customs authorities or seek professional assistance. Customs officers have a comprehensive understanding of the classification process and can provide guidance based on specific product characteristics. They can also clarify any doubts or concerns regarding the classification, ensuring compliance with customs regulations.

Step 5: Completing the Customs Declaration Form

After obtaining a clear understanding of the customs classification requirements, it is time to complete the customs declaration form. The form will typically require specific details about the mold frames, such as the classification code, description, quantity, value, and origin. Ensure accuracy and provide all necessary supporting documents to avoid delays or complications in the customs clearance process.

Step 6: Submitting the Customs Declaration and Paying Duties

Once the customs declaration form is completed, it should be submitted to the relevant customs authorities. Along with the declaration, any applicable customs duties or fees should also be paid. Failure to comply with customs regulations or incorrect classification may result in additional fines or delays in the import or export process.

Conclusion

Declaring customs classification for mold frames is a crucial step in the import or export process for businesses operating in the mold base industry. By understanding the customs classification requirements, gathering relevant information, reviewing the HS codes, consulting with customs authorities, and completing the necessary documentation, businesses can ensure compliance and streamline the customs clearance process. It is essential to stay updated with any changes in customs regulations to maintain smooth international trade operations.