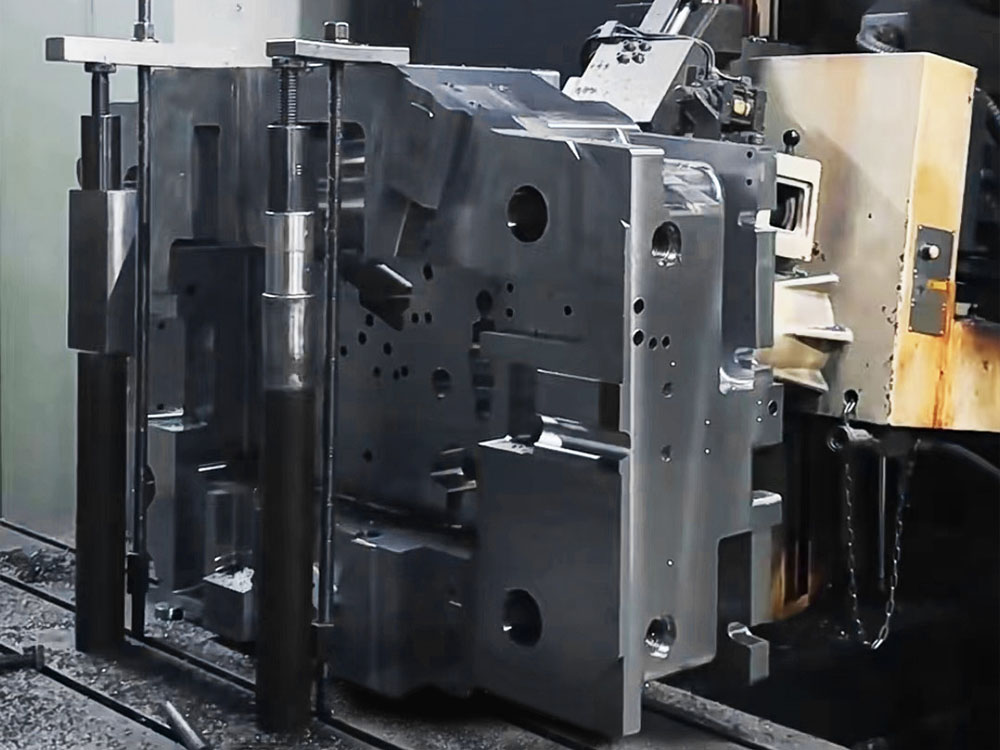

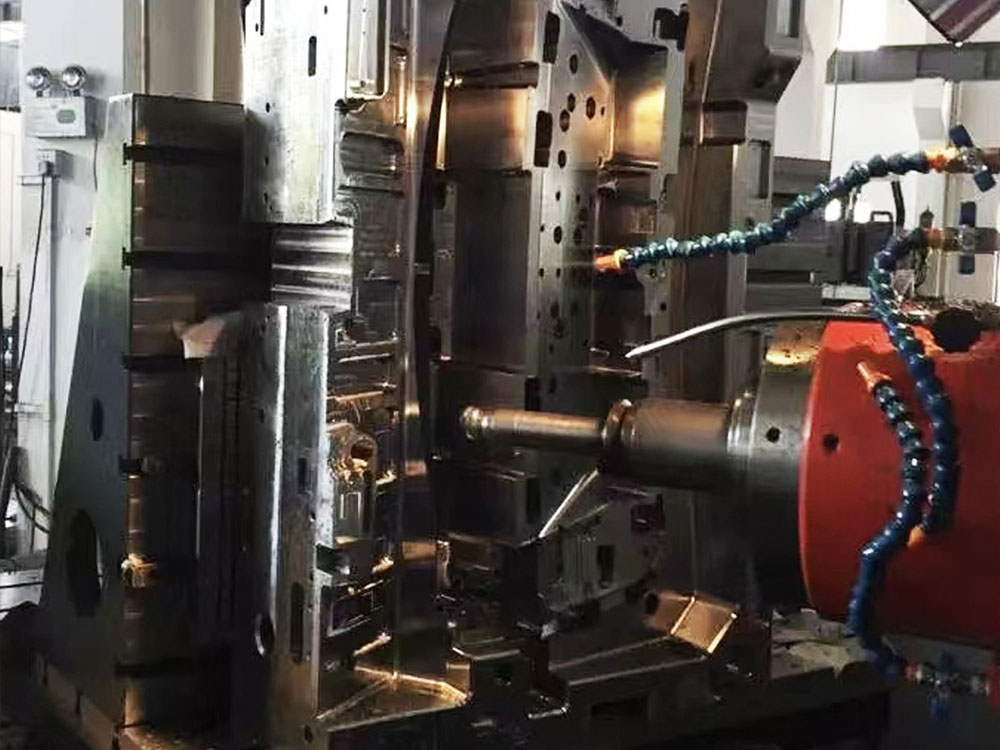

Profit Calculation for Molded Castings

Molded castings are essential components in various industries, including automotive, aerospace, and manufacturing. As demand for these castings continues to rise, it becomes crucial for businesses in the mold base industry to accurately calculate their profits. This article aims to provide a comprehensive understanding of the profit calculation process for molded castings, considering factors such as material costs, labor costs, and overhead expenses.

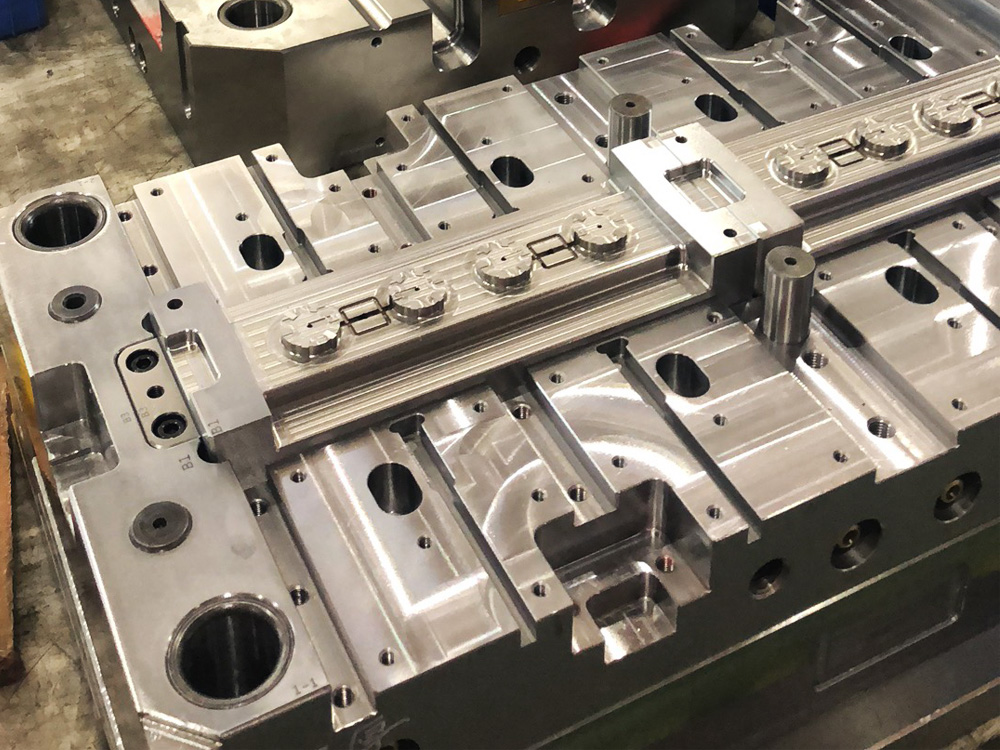

Material Costs

The first step in profit calculation for molded castings is assessing the material costs. The cost of the raw materials used in the casting process, including metals, alloys, and other additives, must be determined. This can be achieved by analyzing the quality, quantity, and market rates of the materials. Additionally, any waste or scrap generated during the casting process should also be taken into account when calculating material costs.

Labor Costs

Next, labor costs play a significant role in determining the overall profitability of molded castings. The labor costs encompass both direct and indirect labor expenses. Direct labor costs involve the wages of the workers actively engaged in the casting process, such as molders, machine operators, and quality control inspectors. Indirect labor costs, on the other hand, include salaries of managerial, administrative, and support staff involved in overseeing the casting operations. The calculation of labor costs should consider factors such as hourly wages, overtime, benefits, and any additional expenses associated with the workforce.

Overhead Expenses

Another essential aspect of profit calculation for molded castings is identifying and allocating overhead expenses. Overhead expenses refer to the indirect costs incurred during the production process, which cannot be directly attributed to a specific unit of output. These expenses may include rent, utilities, equipment maintenance, insurance, depreciation, and various administrative costs. To accurately calculate the overhead expenses, it is crucial to analyze historical data, budget allocations, and cost allocation methods.

Sales and Pricing

Once the material costs, labor costs, and overhead expenses have been calculated, the next step is determining the sales and pricing strategy. In this competitive mold base industry, businesses need to consider market conditions, customer demands, and competitor pricing when deciding on the selling price for molded castings. The pricing strategy should not only cover the production costs but also yield a reasonable profit margin. It is essential to strike a balance between competitiveness and profitability to ensure the long-term sustainability of the business.

Profit Analysis

Finally, after all the costs and pricing strategies have been evaluated, the profit analysis stage enables businesses to determine their overall profitability. This analysis involves comparing the total revenue generated from sales with the total costs incurred during the production process. The difference between the revenue and costs represents the net profit, which reflects the financial success of the molded casting operations.

In conclusion, profit calculation for molded castings involves a comprehensive assessment of material costs, labor costs, overhead expenses, sales, and pricing strategies. It is essential for businesses in the mold base industry to accurately calculate their profits to ensure competitiveness and sustainability. By following a structured approach and considering all relevant factors, businesses can make informed decisions to optimize their profits and meet the growing demand for molded castings in various industries.